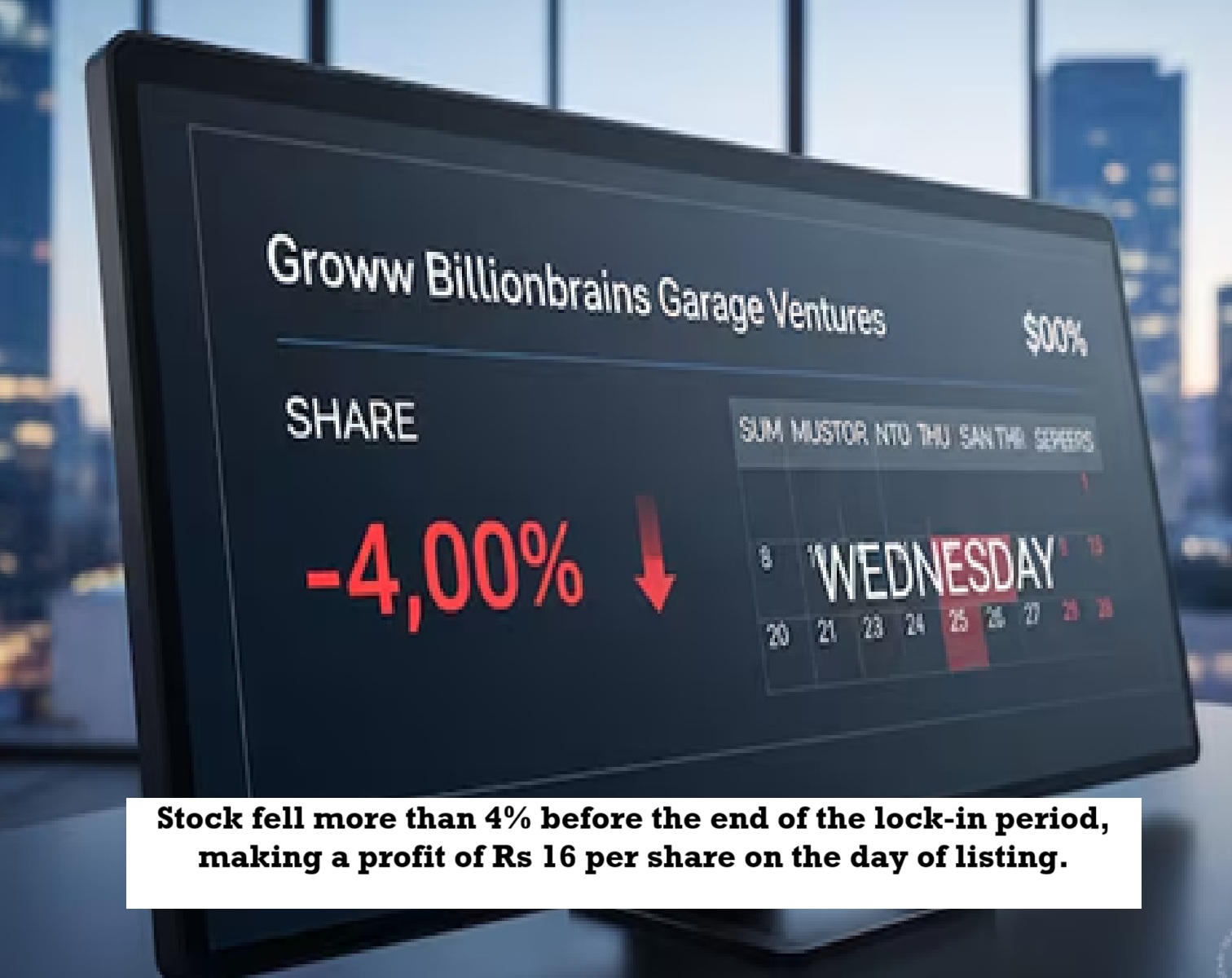

News Topical, Digital Desk : Groww Stock Crash: Shares of Billionbrains Garage Ventures, the parent company of discount broking platform Groww, fell by 4% on Tuesday, December 9. Despite the decline, Groww shares are still trading 47% above their issue price of ₹100.

The company's current market capitalization is ₹90,814 crore. A total of 29.5 million shares were transacted in Tuesday's session, with an average price of ₹146.77. A key date for the stock is December 10th, when Groww's one-month shareholder lock-in period ends.

According to Nuvama Alternative and Quantitative Research, approximately 149.2 million shares, representing approximately 2% of the company's total equity, will become eligible for trading after the lock-in expires. However, the report clarifies that these shares are not required to be sold immediately; they will simply become available in the market. Market expert Deven Choksey, MD, DRChoksey Finserv, advises caution on the stock. According to him, while Groww's business is strong and the rapid growth of retail investors (approximately 100,000 new demat accounts daily) supports it, the stock's valuation has significantly outpaced its fundamentals. He said the market has already priced in earnings estimates through FY28, so he's staying away from the stock. Groww recently listed at a 12% premium to its issue price and closed with a gain of 30% on the first day.

--Advertisement--

Share

Share