Retail investors have shown a lot of interest in Indian equity markets during the last 10 years. According to a recent report by Morgan Stanley, their share in Indian equities has increased by 800 basis points (8%) to 23.4% during this period. The brokerage firm said that this number may increase further in the next few years. Because Indian families are still investing less in equities. India's demographics, infrastructure, investor education and slightly positive real rates will boost equities in India.

According to Morgan Stanley analysts, excluding founders' equity holdings, only 3% of the household balance sheet is in equity by cost. This number can increase to double digits. About 11% of the total wealth has come from equity in the last decade. The brokerage estimates that families have added $8.5 trillion of wealth.

This will be the reason for the increase.

Morgan Stanley expects market and corporate activity to grow in the coming year. But the brokerage has predicted low equity market returns over the next 10 years. However, Morgan Stanley expects the equity market to hit new peaks in the coming five years due to equity recovering slightly from the lows and the capex cycle. The previous record high was 3.5% of market cap in 2009. Corporate borrowings from banks and bond markets are likely to increase after reaching lows last year.

The brokerage further said that activities in cash and derivatives are also likely to increase as investors may rapidly change portfolios over the next few years. This is a clear sign that the bull market is moving towards maturity. According to

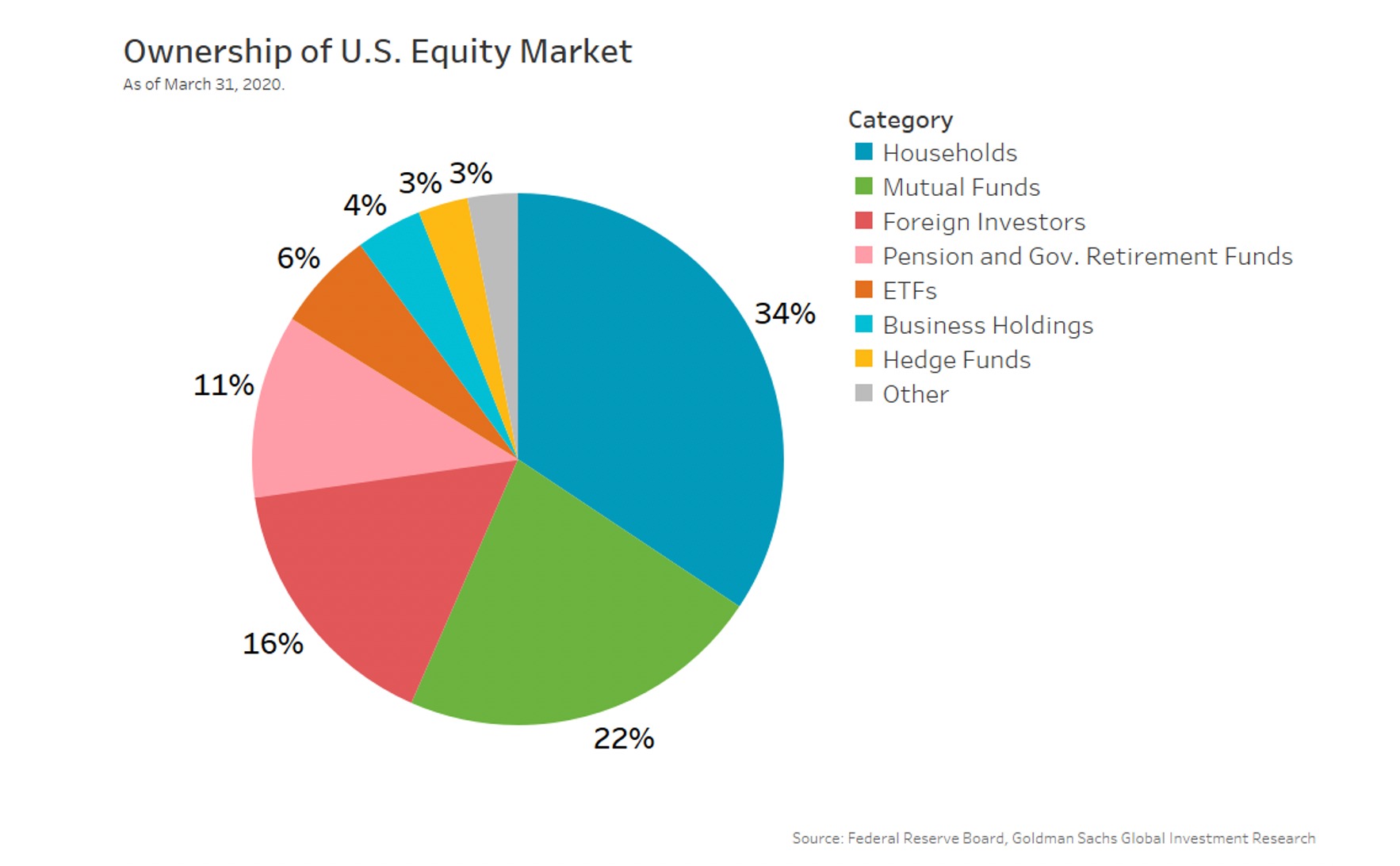

the corporate earnings report, the income of Indian companies is increasing, which will benefit from the emerging private capex cycle, the revival of corporate balance sheets and increased consumption. The brokerage said that trend earnings are currently below GDP, so there is room for upward movement in this cycle and an 18-20% earnings CAGR is forecast for the next 4-5 years. This in turn can take the market up. Domestic Assets According to Morgan Stanley, foreign investors will continue to be attracted to Indian equities. Apart from this, increasing index weights also make India's equity market an attractive option. According to the report, bond flows due to India's inclusion in the bond index will help maintain external conditions. India has proved to be a profitable market for private equity, venture capital funds and sovereign funds. Even though the conditions are better for the Indian markets, some risks are also present. According to Morgan Stanley, in the long-term, India will face capacity constraints in bureaucracy, judiciary, healthcare, education and skill training, while other risks include geo-politics, the impact of artificial intelligence (AI) on the tech industry, low productivity in the agricultural sector, climate change, state-level fiscal challenges and lack of adequate factor reforms. The report warns that the valuation of Indian markets, especially on parameters such as market cap to GDP, appears to be stretched. Apart from this, the number of equity issuances may also increase due to corporate India seriously pushing the capex cycle.

The brokerage said that many small and mid-cap stocks appear overvalued. Meanwhile, a tight policy environment (fiscal and monetary) could put growth at risk, especially if the world slows down. A global recession or a sharp rise in oil prices could hurt India's growth as well as funding.

Read More: Third quarter GDP may increase, what is the reason? Learn everything from the report.

--Advertisement--

Share

Share