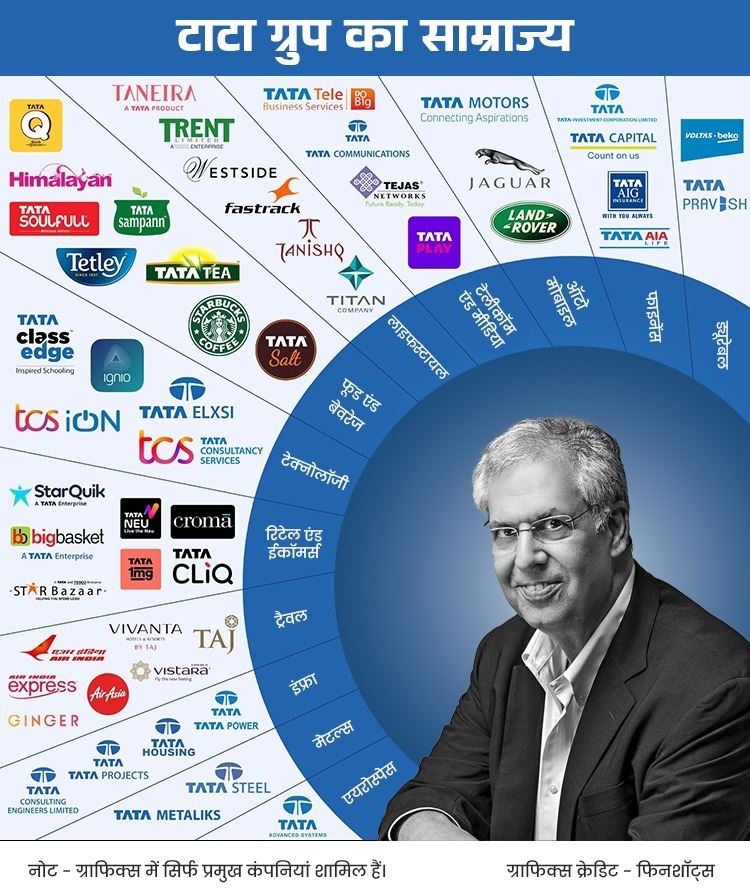

New Delhi: Hyundai Motor India's issue is currently the country's biggest IPO. Its listing in the stock market was quite dull. But, one IPO can break Hyundai's record and can also give huge listing gains to investors. That is, Tata Tuns.

Actually, Tata Group did not intend to list its largest company Tata Sons in the stock market. It had also sought exemption from RBI in this regard. The central bank has classified Tata Sons as an Upper Layer NBFC.

Tata Sons will no longer get exemption

RBI believes that there should be financial transparency in the functioning of upper layer NBFCs. Therefore, it has made a rule for all such non-banking finance companies (NBFCs) to get listed in the stock market by September 2025. But, Tata Sons did not want to get listed in the stock market, so it had sought exemption from the banking regulator in this regard.

According to media reports, RBI has now refused to give any kind of exemption to Tata Sons. This means that now Tata Sons will have to bring its IPO and get listed in the stock market by September 2025. However, there is no official statement from the Tata Group yet regarding what its next step will be.

Can Tata Sons avoid listing?

If Tata Sons still wants to avoid bringing an IPO and getting listed in the stock market, then it will have to reduce its debt. In the financial year 2022-23, Tata Sons had a debt of about Rs 20,270 crore in its balance sheet. If it reduces its debt to less than Rs 100 crore, then it can go out of RBI's upper-layer NBFC category.

If Tata Sons does this, it will no longer need to bring an IPO or get listed on the stock market. It is also considering repaying the debt or transferring its stake in Tata Capital to another entity. By doing this, Tata Sons can de-register as a core investment company (CIC) and upper-layer NBFC.

How big will the IPO of Tata Sons be?

Last year, there was news that if Tata Sons launches an IPO, its valuation could be Rs 11 lakh crore. This means that if it sells even 5 percent of its stake, the size of its IPO will be around Rs 55,000 crore. This will be almost double the size of Hyundai India's IPO of Rs 27,870 crore.

The shares of many companies of Tata Group are continuously rising. In this situation, the valuation of Tata Sons can be even higher. It can create such a record on Dalal Street, which may not be broken in the coming years. Whether Tata Sons will bring its IPO or not, its entire responsibility now lies with the new chairman of Tata Trust, Noel Tata.

Who has how much stake in Tata Sons?

According to the shareholding pattern of Tata Sons, about 65.9 percent of it is owned by Tata Trust. Shapoorji Pallonji has 18.4 percent, different companies of Tata Group have 12.8 percent and Tata family has 2.8 percent stake.

Tata Motors and Tata Chemicals both hold around 3 per cent stake in the holding company. Tata Power holds 2 per cent and Indian Hotels holds 1 per cent.

Read More: US Market: US markets saw a sharp decline, AI tensions weighed on investors.

--Advertisement--

Priya

Priya Share

Share