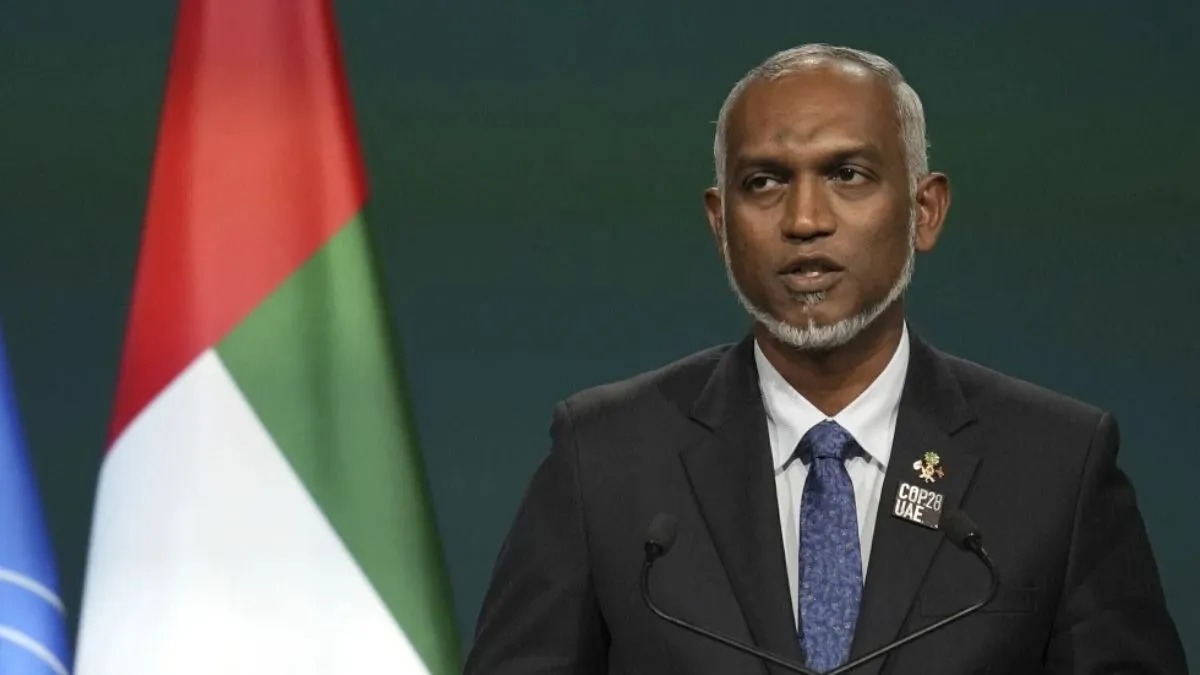

Male: Neighboring country Maldives has fallen into a deep financial crisis after messing with India. However, in the meantime, Maldives President Mohammad Muizzu has come to New Delhi and met PM Modi to do damage control and start initiatives to improve relations with India. Despite this, Maldives' crisis is not reducing. So now Maldives, which is facing a dollar crisis, has implemented a new foreign exchange regulation. Under this, the type of transactions in foreign currency has been limited and mandatory foreign exchange control has been imposed on tourism establishments and banks.

Let us tell you that the economy of Maldives has suffered a setback after Indian tourists were called upon to stay away from this beautiful island country in response to President Mohammed Muizzu's 'India Out' campaign last year. Last month, Maldives escaped a possible default in Islamic bond payment, as India gave it an interest-free loan of five million dollars. With foreign exchange reserves not matching the import bill, the Maldives central bank Maldives Monetary Authority (MMA) introduced a new regulation on October 1, under which all foreign exchange earnings generated by the tourism industry will be required to be deposited in local banks.

What are the restrictions in Maldives

The MMA, which imposed strict dollar limits in the Maldives in August due to a dollar shortage, published new regulations in the local Dhivehi language. According to the Foreign Exchange Regulation (Regulation No: 2024/R-91), all transactions within the Maldives must be made in Maldivian Rufiyaa (MVR), except for transactions that are explicitly permitted in foreign currency. According to the new regulation and FAQ issued by the MMA, it also provides that payments for goods and services, prices of works, fees, charges, rent and wages shall be made in local currency and the issuance of bills in foreign currency for these transactions is prohibited.

--Advertisement--

Priya

Priya Share

Share