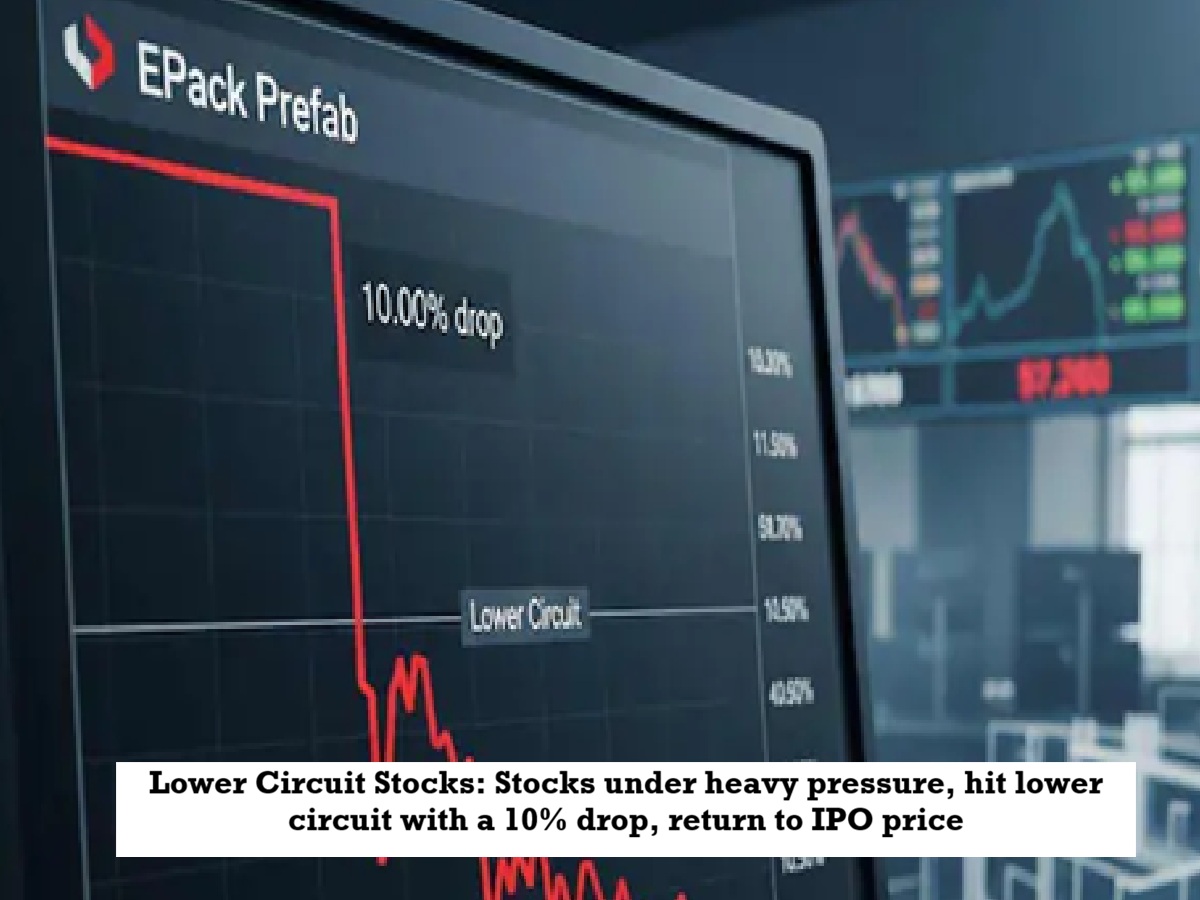

News Topical, Digital Desk : Lower Circuit Stocks: Shares of EPack Prefab Technologies Ltd. came under heavy selling pressure on Thursday, January 22. Following the release of December quarter (Q3) results, the stock fell nearly 10% to hit the lower circuit at ₹205.30, which is around its IPO price.

The company's profitability improved on a year-over-year (YoY) basis. Net profit rose 45% to ₹16.8 crore, driven by a sharp increase in other income, compared to a decline in the same quarter last year. Other income during this period was ₹5.9 crore, which was only ₹4 lakh a year ago. The company's revenue increased by 22.1% from ₹266.4 crore to ₹325.3 crore, while EBITDA increased by 21.7% to ₹32.7 crore. EBITDA margin remained stable at 10.1%. However, performance remained weak on a quarter-on-quarter (QoQ) basis.

What is the state of earnings? Compared to the previous quarter, revenue declined by 25% from ₹433.9 crore to ₹325.3 crore. EBITDA also fell by 34.6% from ₹50 crore to ₹32.7 crore. EBITDA margin declined from 11.5% to 10.1%, while net profit fell 43% from ₹29.5 crore to ₹16.8 crore. Other income increased from ₹2.8 crore to ₹5.9 crore on a QoQ basis. Despite near-term pressures, the company provided positive signals regarding its order book and execution outlook. The company's order book stood at ₹1,216 crore, a 32% increase quarterly compared to ₹920 crore a year ago.

What did the company say? Capacity expansion plans are also progressing as scheduled. The company has acquired 39 acres of land in Gujarat, while the Mambattu brownfield facility is expected to be closed by the end of FY26. Sanjay Singhania told CNBC-TV18 that the second half of the financial year is expected to be stronger than the first half. He stated that execution was impacted in Q3 due to the prolonged monsoon and site unavailability, but revenue is expected to recover sharply in Q4. The company expects revenue of ₹450-500 crore in Q4 and reiterated its full-year revenue guidance of ₹1,500-1,550 crore for FY26. A pending order book of ₹350-400 crore provides revenue visibility for the next 7-8 months. EPack Prefab Technologies operates in two major business verticals. Its prefab business handles turnkey projects, including the design, manufacturing, installation, and erection of pre-engineered steel buildings and prefabricated structures in India and abroad. The EPS packaging business manufactures expanded polystyrene sheets and blocks used in construction, packaging, and consumer goods.

Read More: Stock Crash: Shock from Q3 results! Company shares plunged 12 percent

--Advertisement--

Share

Share