As the trading week came to a close, all eyes were on Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) to gauge market sentiment. The activity of these institutional investors on Friday provides crucial insights into what could unfold in the coming week.

FIIs’ Moves on Friday

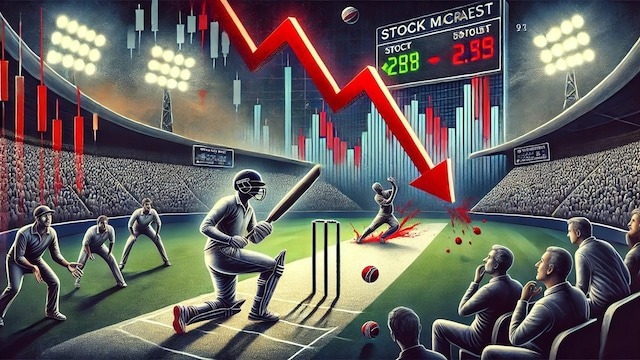

FIIs have been actively reshuffling their portfolios in response to global and domestic market conditions. Whether they were net buyers or sellers on the last trading day of the week plays a significant role in predicting short-term trends. If FIIs offloaded shares, it could indicate caution due to global uncertainties. On the other hand, sustained buying would reflect confidence in India’s market resilience.

DII Activity and Market Stability

Domestic Institutional Investors (DIIs), including mutual funds and insurance companies, often act as a stabilizing force in the market. If DIIs stepped in as strong buyers on Friday, it could help counterbalance FII selling pressure and support market levels heading into next week.

What’s Next for the Market?

- Global Cues: Any developments in the U.S. economy, interest rate signals, or geopolitical tensions will influence FII sentiment.

- Domestic Factors: Inflation data, corporate earnings, and policy updates will be key drivers for DII participation.

- Market Trends: If FIIs continue selling, the market may see pressure in the early part of the week. However, if DIIs maintain strong buying momentum, the impact could be limited.

Read More: US Market: Sharp decline in US stock market, Dow falls by 1100 points, what is the reason?

--Advertisement--

Share

Share_311079482_100x75.jpg)

_1401595695_100x75.jpg)